|

2013 Tax Change Follow these steps in order to change the tax rates for 2013. First, make sure that you have no more customer invoices or customer order entry invoices to prepare. 1 - Go to Common Services and click on Tax Services. Next, click on Tax Rates.

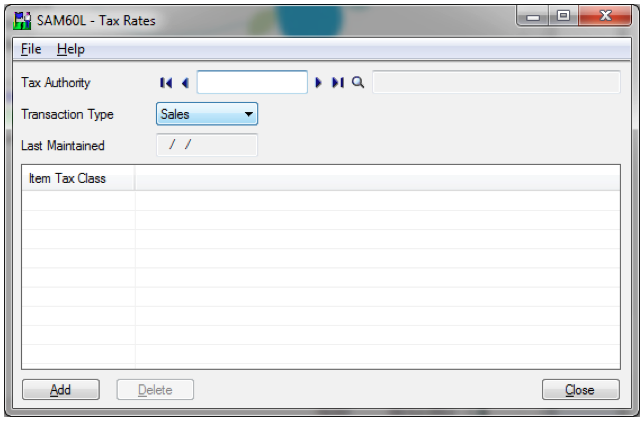

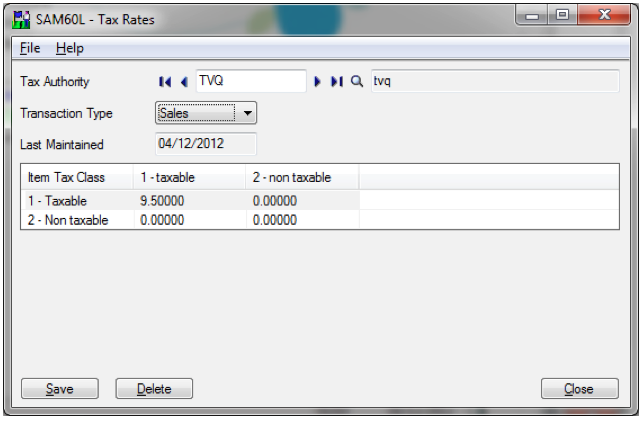

2 - In the Tax Authority field, select the QST option or your tax code corresponding to the QST.

3 - Change the current 9.5 rate to 9.975 and click on Save. This step must also be completed for Sales and Purchase transactions. Once you have finished, click on Close.

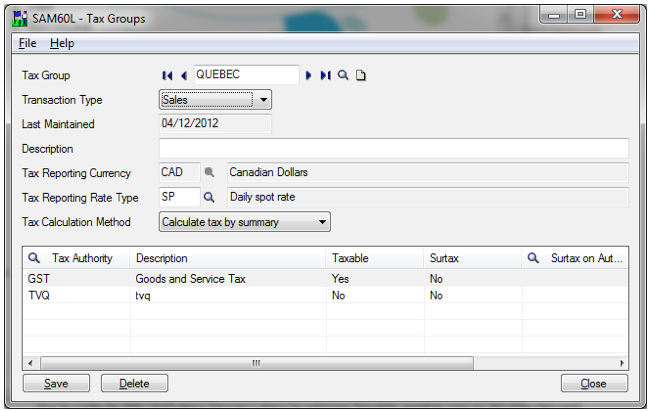

4 - On the Tax Services screen, click on Tax Groups.

5 - Choose the tax group corresponding to the GST and QST.

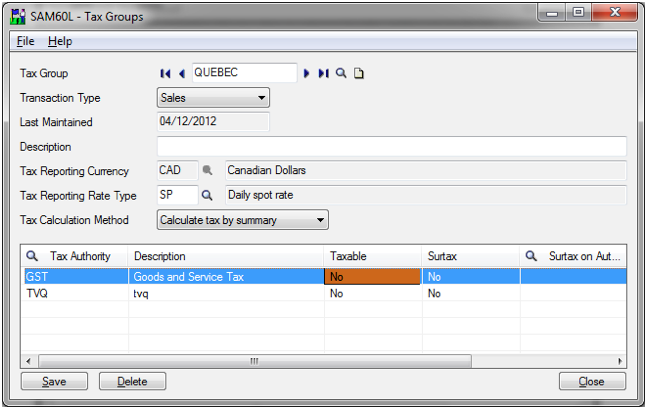

6 - In the Taxable column of the GST line, enter No by double-clicking. This step must also be completed for Purchase transactions. Once you have finished, click on Save and Close.

If you have any questions or need support regarding this procedure, please contact our team at [email protected]. ← Back |

|