2013 Tax Change

Follow these steps in order to change the tax rates for 2013.

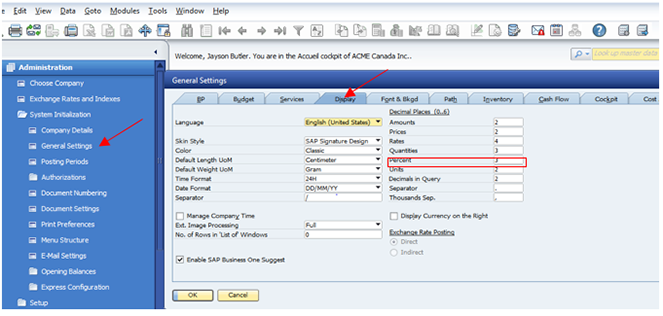

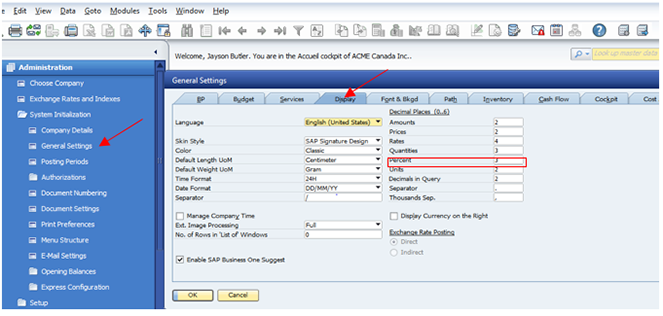

1 - Make sure that the percentages allow for three decimal places.

→ Administration → System Initialization → General Settings → Display tab

Make sure that 3 is entered in the Percent field

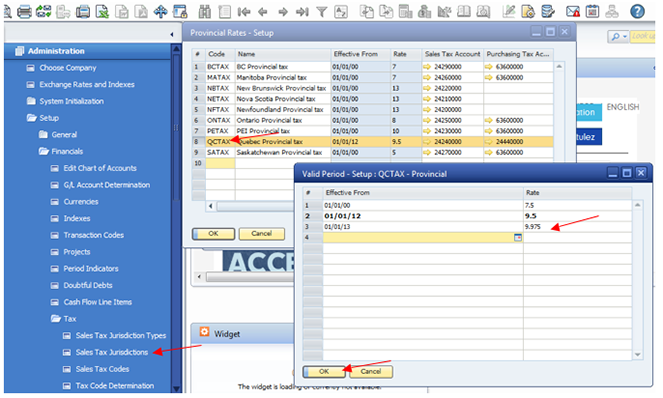

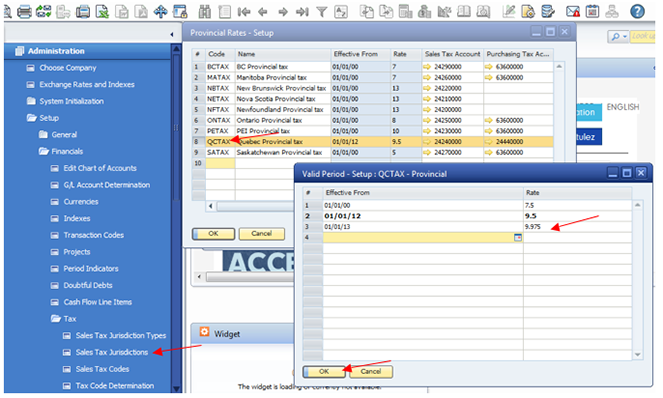

2 - Change the tax rate, effective from January 1, 2013.

→ Administration → Setup → Financials → Tax → Sales Tax Jurisdictions → Select Provincial → OK

- In the ‘Provincial Rates - Setup window’, select the Quebec tax code line currently applicable

- In the Valid ‘Period - Setup window’, add a line with the new tax code effective from January 1, 2013.

- Click on Update → OK

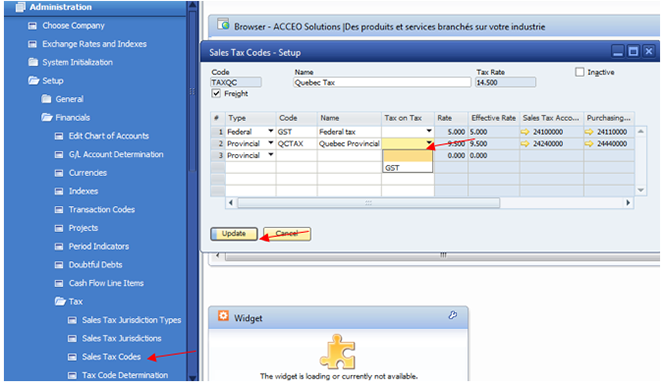

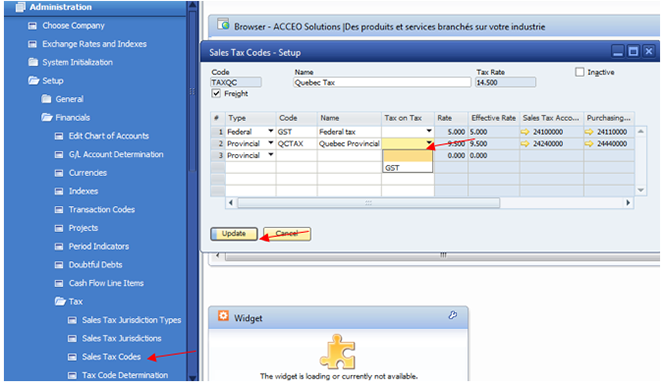

3 - Change the tax calculation method

→ Administration → Setup → Financials → Tax → Sales Tax Codes

- Select the appropriate Quebec tax code

- Change the Tax on Tax column so that it is empty

- Click on Update

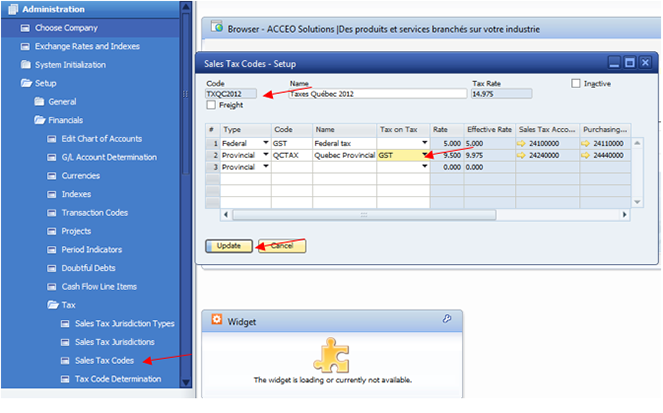

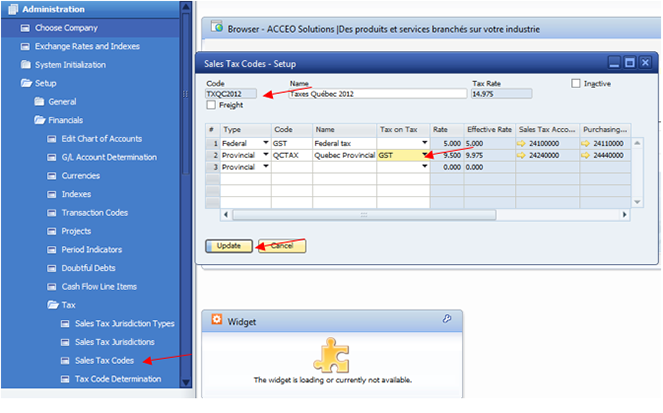

4 - Add a new tax code for 2012 taxes

*** This code must be used for invoices entered in January but applicable to December 2012 ***

→ Administration → Setup → Financials → Tax → Sales Tax Codes → Add mode

- Create a new tax code for 2012

- Set the Tax on Tax to GST for provincial tax

- Create

- Click on Update

If you have any questions or need support regarding this procedure, please contact our team at [email protected].

← Back |