|

How to Change the QST Rate for 2013 New QST Rate Coming into Effect on January 1, 2013 This article discusses the QST change which is coming into effect on January 1, 2013. As a result of this change, the QST rate will be 9.975%, and the GST will no longer be taxable. The steps suggested by ACCEO Solutions' Dynamics GP team can be summarized as follows

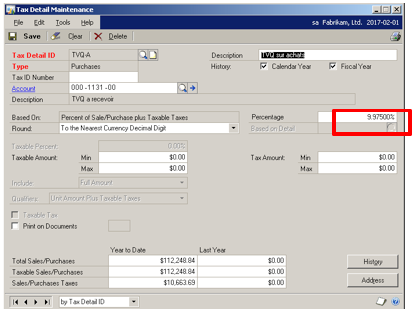

Important 1 - Change the current purchase and sale QST tax code rates for the 9.975% rate. Below is an example showing how to change the QST for purchases (repeat the operation for QST-Sales).

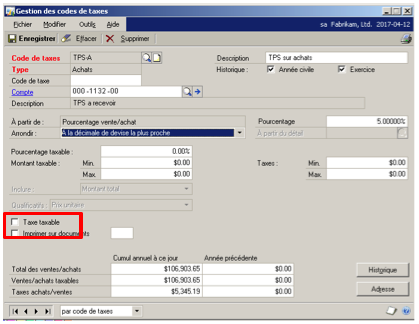

2 - Uncheck Taxable Tax in the current purchase and sale GST tax codes. Below is an example showing how to change the GST for purchases (repeat the operation for GST - Sales).

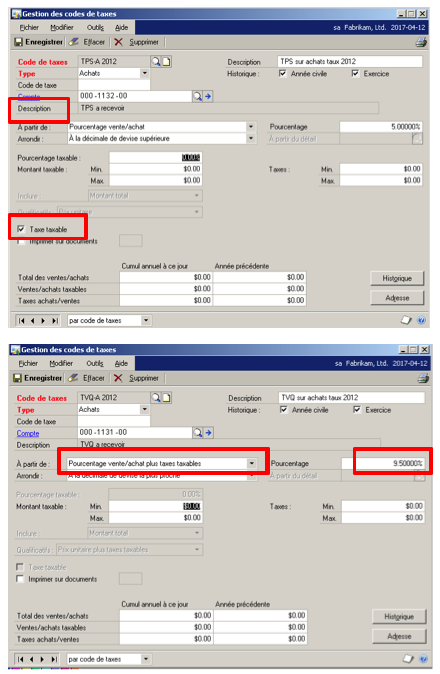

3 - Create new purchase and sale GST and QST tax codes with the 2012 settings. This operation is important in case it is necessary to make transactions using the old rates. Below are some examples applied to taxes for purchases

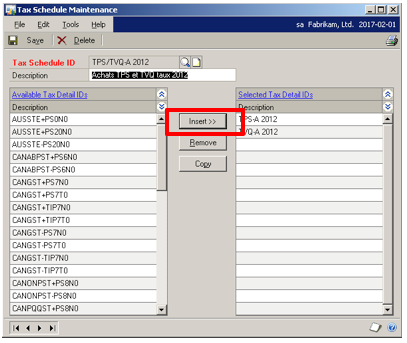

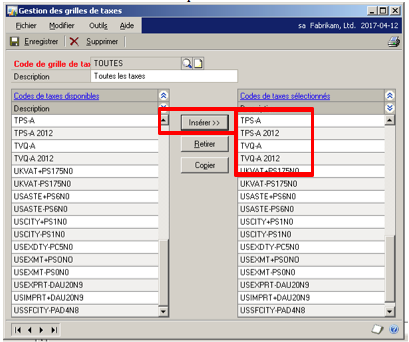

4 - Create new tax schedules which include the new tax codes Below is a tax schedule containing the taxes for purchases with GST and GST

5 - Assign new tax codes to the ALL DETAILS tax schedule. This setting ensures that the new tax codes are calculated correctly when used in different transactions for customers and vendors.

6 - Carry out tests with forms (e.g., sales and/or purchase forms). This operation is performed in order to verify tax amounts for documents created after January 1, 2013, and to ensure that the forms which use current tax schedules and the new rates display the desired amount. *Note: After the tax change of January 1, 2013, if documents are created with the old rates and, thus, with the new tax codes, the tax amounts associated with these transactions might not be printed on the forms (e.g., sales documents).

← Back |

|